Saver Token Vs Stablecoins

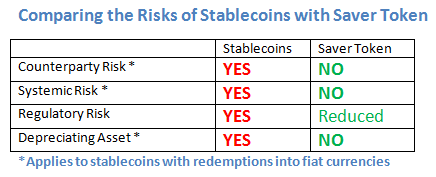

Saver Token can be used as a stablecoin by crypto-traders. It has some distinct advantages over most current stablecoins:

- Stable money. Because of their link to fiat currencies most stablecoins are in fact depreciating assets. For example the stablecoins linked to the US dollar loose on average 33% of their value every ten years. In contrast the Target Price of Saver Tokens is linked to the US Consumer Price Index (CPI-U), widely considered a measure of inflation.

- De-risk. Because Saver Token is structured like Bitcoin and other crypto-currencies with no underlying assets it avoids many of the risks inherent in most stablecoins. These include:

counterparty risk – the risk of the stablecoin’s bank or trust or other intermediary defaults

systemic risk – the risk the fiat financial system has a meltdown similar to the 2008 Financial Crisis

operational risk – various risks created by having a centralised issuer/redemption organisation including fraud, theft and operational failure.

Customer support service by UserEcho