How Saver Token Works

Saver Token has 4 components:

- The Sponsor – this is the person or organisation that creates the blockchain tokens and publishes the Target Price at which the tokens are expected to trade at. As the Target Price can be readily calculated from the latest CPI-U the Sponsor's only real role is the sale of tokens.

- The Investor – that is you and others that want to participate in the Saver Token.

- The Target Price – the expected price the tokens trade at on an exchange

- The Exchange – the trading platform where token holders and buy and sell tokens and where actual price discovery takes place. In the case of Saver Tokens this is the Waves decentralised exchange (DEX).

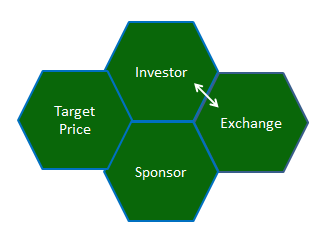

Buying and Selling a Token

Savers are blockchain tokens. This enables ownership of tokens purchased to be recorded without the need for a third party.

People can buy their tokens from either the Sponsor or other token holders on the exchange. Tokens can be sold to other people on the exchange. Like all markets, there may be times when there are not enough buyers on the exchange for this to happen (lack of liquidity).

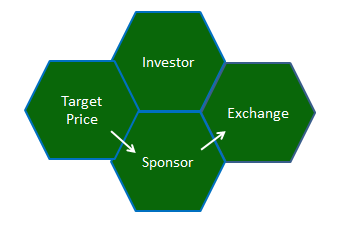

At our discretion we as the Sponsor also maintain a reserve to buy Savers at the Target Price minus 2% as a way of assisting liquidity. We have no obligation to do this but do so to aid the smooth functioning of the system.

Expansion of Supply

Supply of tokens increases when the Sponsor sells on the exchange. The Sponsor only sells tokens at the Target Price + 2%. This premium ensures the expansion of supply is driven by market demand and helps prevent the debasement of the token’s value. It also preserves liquidity for other token holders wishing to trade their tokens at the Target Price as these tokens will be sold first before people would be willing to buy at the 2% premium.

Maintaining the Peg

The main way the price of the tokens on the exchange is kept pegged to the Target Price is through the expectation and self-interest of token holders. There is no reason to own tokens except to trade them at the Target Price. Therefore it is in everyone’s interest that this takes place, even if this sometimes means waiting for there to be sufficient buyers on the exchange to sell your tokens. This combination of expectation and self-interest is likely to be the reason why gold kept a constant value for hundreds if not thousands of years – people needed a stable form of exchange and therefore they gave gold this stability.

Customer support service by UserEcho